lhdn e filing guide

Those who fail to do so can face legal action so make sure. According to Lembaga Hasil Dalam Negeri LHDN also known as the Inland Revenue Boardthose earning at least RM34000 a year after EPF deductions need to pay taxes.

Im a complete noob when it comes to doing anything hands-on.

. Click Customer Feedback CUSTOMER FEEDBACK FORM APPLICATION PIN NUMBER CAN BE MADE VIA LOG ON wwwhasilgovmy Portal Rasmi LHDNM 1STEP 7. These are the steps to fill up e-Filing online through the ezHASiL portal. Challenge Phrase Change User Guide.

Select applicable form type and Year of Assessment. LHDN e-Filing Guide For Clueless Employees The hardest thing in the world to understand is the income tax Albert Einstein 1879 1955 Ill come right out and say it. Blog draft LHDN e-Filing Guide For Clueless Employees.

Login Tax Agent User Guide. A simple application that offers quick access to the process of filling and submitting income tax forms while providing a self-profile update function. Organizational e-Filing OeFUser Guide - Roaming PKI.

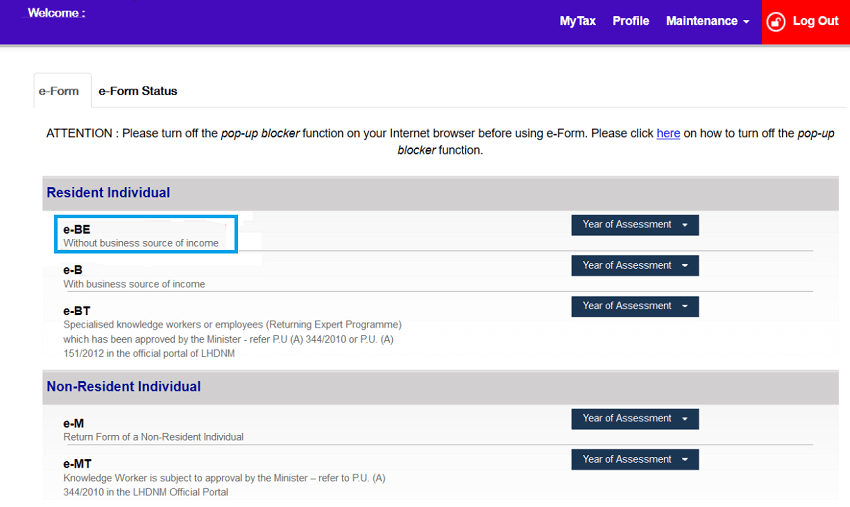

Go to e-BE and select last year under the Year of Assessment Image via SAYS As mentioned earlier this guide is for Malaysian salaried employees. Perhaps youre a fresh grad or a student doing part-time work. Sample Company Return Form 2021 and Appendices.

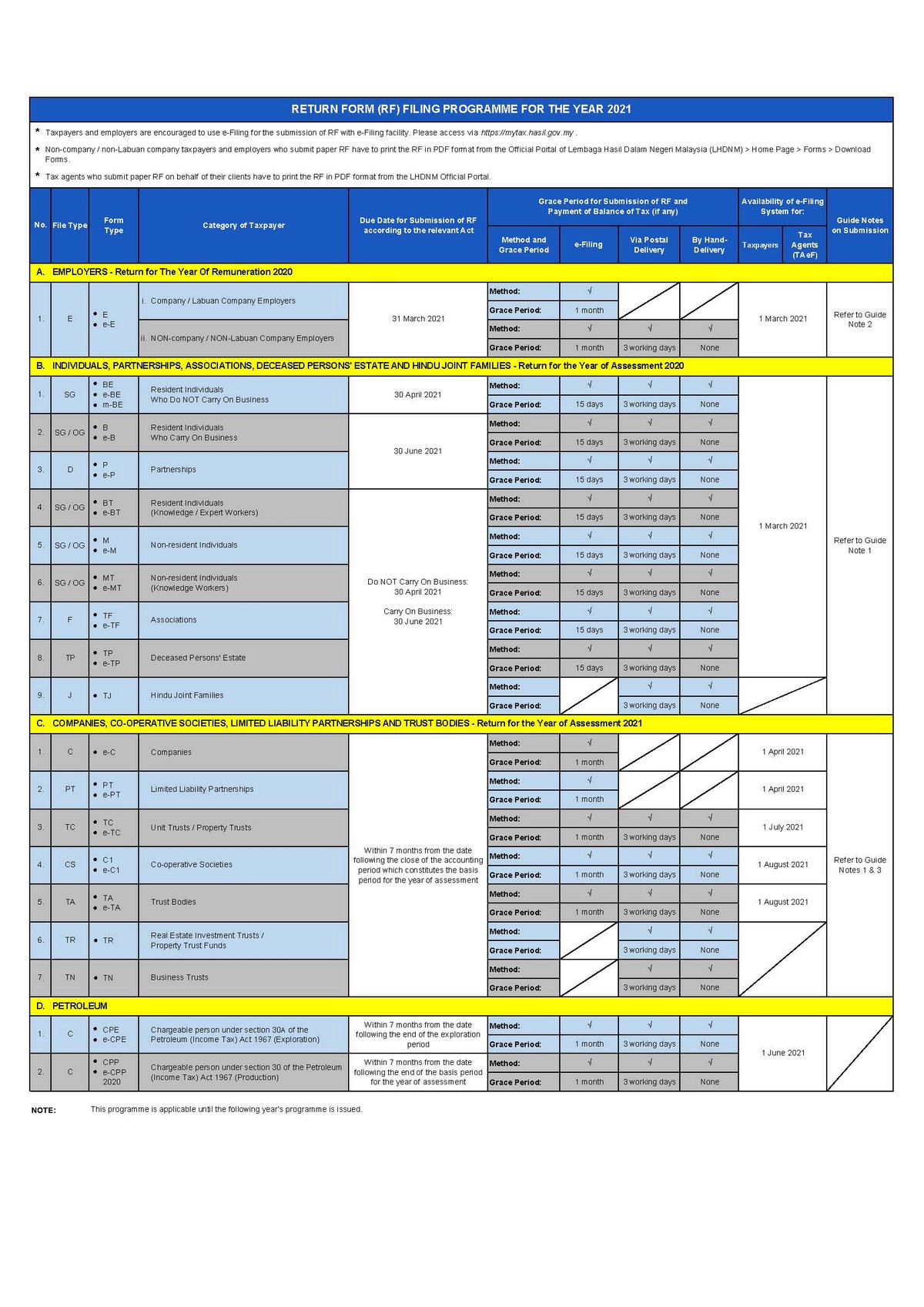

Then scan your IC in PDF format. Form E for the Year of Remuneration 2019 i Submission of a Complete and Acceptable Form E a Form E shall only be considered complete if CP8D is furnished on or before the due date for submission of the form. Visit ezHASiL and go to the website menu Customer Feedback.

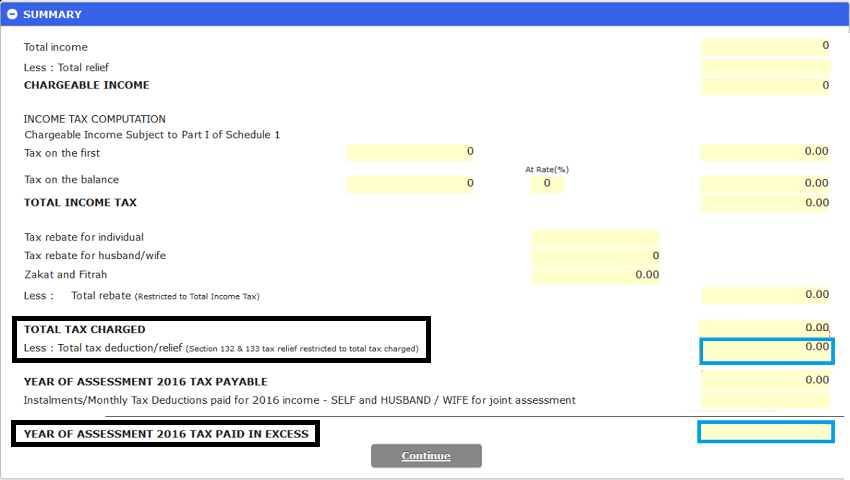

Register at the nearest IRBM Domestic Revenue Council of MalaysiaLHDN Lembaga Hasil Dalam Negeri or register online at hasilgovmyProvide copies of these. Choose Borang to file tax according to the source of income. Sign Online button or tick the preview image of the form.

Click on e-Formlink under e-Filing menu. B Form E and CP8D must be submitted in accordance with the format as provided by LHDNM. User Manual e-Form ezHASiL version 33 8 14 e-Form Services screen will be displayed when users successfully login ezHASiL as below.

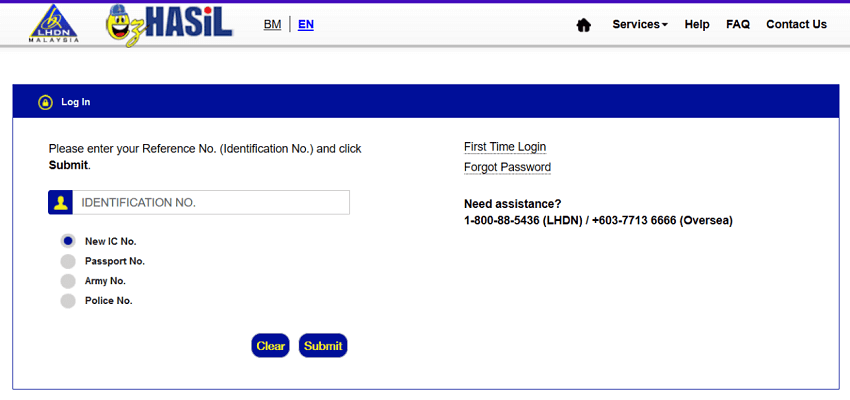

After obtaining No Pin e-Filing and No Rujukan click on the following URL to log in to the income tax page-Select Login kali pertama. Hakcipta Terpelihara 2007 Lembaga Hasil Dalam Negeri Malaysia. Once you have logged into your ezHasil account select e-Form under the e-Filing section Image via SAYS 10.

How to complete the Boring e filing then form online. MAKLUMAN Sesi BEBBTMMT anda telah tamat tempoh pada 21-Jun-2022 215402554 Sila login semula untuk teruskan. EzHASiL System will display screen as below.

Fill in the information according to the matter and. And register for Digital Certificate Login and Complete Online Form e-BE Sign the e-BE digitally and submit Successful- Acknowledgement Receipt of e-BE TAX NUMBERAPPLICATION THROUGH e-Daftar Please Visit wwwhasilgovmy LHDNM Official Portal or edaftarhasilgovmy Click online registration form. Need to obtain PIN No.

Wednesday 15 May 2019 and Monday 15 July 2019 However please resist the urge to wait till the last minute to file your taxes. To get started on the document utilize the Fill camp. The advanced tools of the editor will guide you through the editable PDF template.

Then click on e-Filing PIN Number Application. Up to 24 cash back keeping you away from Infographic below will guide youFirst timer easy guide filing fees 2019Registered at LHDNJe you are newly taxed you must register an income tax number. E - Janji Temu.

Fill up your income tax return form Make sure you choose the right type of ITRF depending on which category of income you fall under. After your document is successfully uploaded click Next. E-Filing1 Easy Steps of Get your PIN No.

Who needs to file income tax. Melayu Malaysia MYTAX Content. Remember that you can choose to view e-Filing your form and in act the entire LHDN website in either English or BM just select the language of your choice at the top of the screen.

Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. E-BE part-time worker. First Time Login Tax Agent User Guide.

Paling sesuai dengan paparan resolusi 1024. Download Form CP55D and fill in the required information. In Malaysia you can start filing your taxes as early as 1 March.

Since this guide is about e-filing your important dates are. To register Digital Certificate before filling in the e-Form ITRF 6. When its time to wax poetic and.

GUIDE NOTES ON SUBMISSION OF RF 2. With effect from Year of Assessment 2014 companies are required to furnish their returns based on audited accounts and submit via electronic medium or by way of electronic transmission to Lembaga Hasil Dalam Negeri Malaysia.

Ctos Lhdn E Filing Guide For Clueless Employees

Guide To E Filing Income Tax Malaysia Lhdn Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com Tax Guide Income Tax Tax Refund

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

How To Do E Filling For Lhdn Malaysia Income Tax Md

How To Do E Filling For Lhdn Malaysia Income Tax Md

The Gobear Complete Guide To Lhdn Income Tax Reliefs Otosection

How To Step By Step Income Tax E Filing Guide Imoney

Guide To Using Lhdn E Filing To File Your Income Tax

Ctos Lhdn E Filing Guide For Clueless Employees

No comments for "lhdn e filing guide"

Post a Comment